what is fit tax on paycheck

The table below provides the total amounts. If youre one of the lucky few to.

How To Do Payroll In Excel Free Template Payroll Template Payroll Bookkeeping Templates

Federal income tax might be abbreviated as Fed Tax FT or FWT.

. 6 hours agoClarence Cook is single and claims no allowances. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. Fit is the amount required by law for employers to withhold from wages to pay taxes.

The federal income tax is a tax on annual earnings for individuals businesses and other legal entities. Federal Paycheck Quick Facts. His gross pay for the week is 537.

The amount of income you earn. What is the fit tax rate for 2020. All salaries cash gifts wages from business income gambling income employers.

Lets start our review of the 1000000 Salary example with a simple overview of income tax deductions and other payroll deductions for 2022. Your federal withholding is the amount that youve already paid the federal government. All wages salaries cash gifts from employers business income tips gambling.

10 12 22 24 32 35 and 37. 10 12 22 24 32 35 and 37. There are seven federal tax brackets for the 2021 tax year.

There are two federal income tax withholding methods for use in 2021. For employees withholding is the amount of federal income tax withheld from your paycheck. So when you file your return youll get.

It depends on. Median household income in 2020 was 67340. These are the rates for.

The employee is responsible for. FIT is the amount required by law for employers to withhold from wages to pay taxes. For most people FIT are the taxes that.

The federal income tax has seven tax rates for 2020. Income taxes are taxes on income both earned salaries wages tips commissions and unearned interest dividends. Your bracket depends on your taxable income and filing status.

Both Social Security and Medicare taxes are fixed-rate taxes you withhold from your employees wages and pay on behalf of your employees. The amount of federal income tax. This amount is based on information provided on the employees W-4.

There are seven federal income tax rates in 2022. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Federal income tax rates range from 10 up to a top marginal rate of 37.

With this information you can prepare for tax season. The amount of income tax your employer withholds from your regular pay. The federal income tax rates remain unchanged for the 2020 and 2021 tax years.

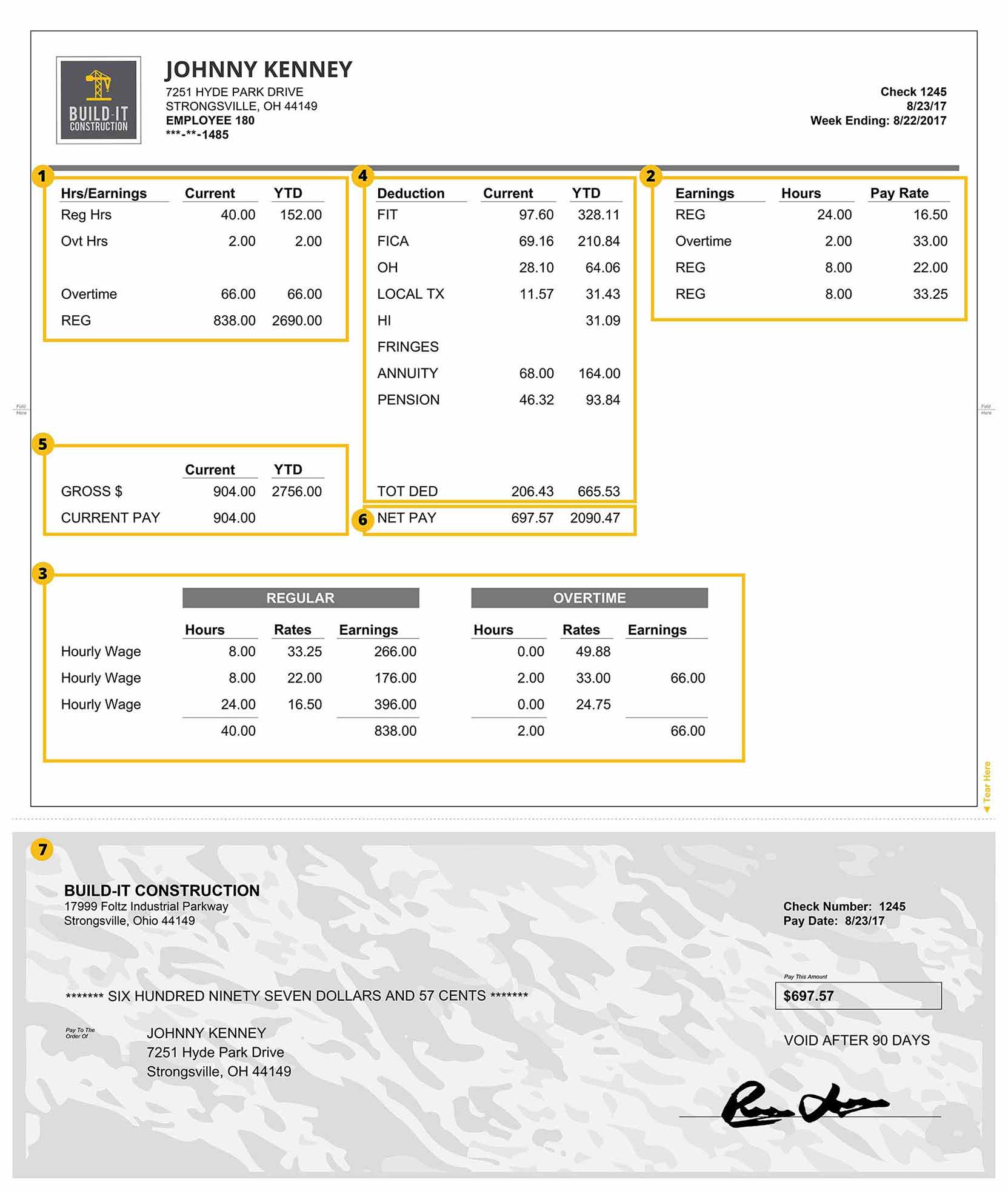

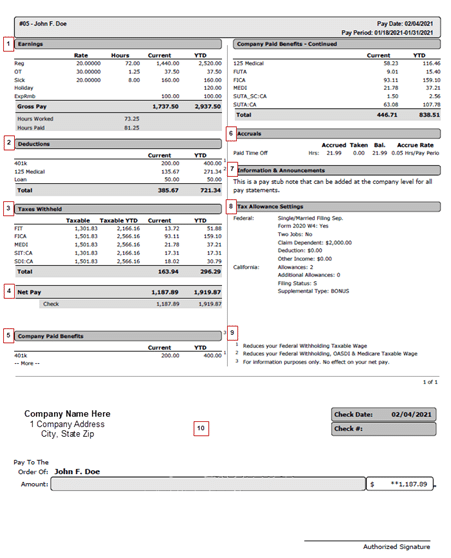

Wage bracket method and percentage method. Using Figure 23 66 will be withheld from Cooks pay for federal income tax. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. What percentage is fit tax. The FIT is a form of tax on yearly incomes for businesses individuals and additional lawful entities.

Business Order Form Invoice Printable Sheets Etsy In 2022 Printables Invoicing Budget Printables

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Budget Planner Printable Sheetsmonthly Bill Planner Etsy Budget Planner Printable Printable Planner Printable Stationery

How To Do Payroll In Excel Free Template Payroll Template Payroll Bookkeeping Templates

Understanding Your Pay Statement Innovative Business Solutions

Budget Printable Editable Paycheck Budgeting Personal Etsy Paycheck Budget Budgeting Budget Printables

Understanding Your Paycheck Credit Com

Free 8 Sample Medical Invoice Templates In Ms Word Pdf Invoice Template Bill Template Medical Billing

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Different Types Of Payroll Deductions Gusto

Savings Trackerincome And Expensessavings Accountsaving Etsy In 2022 Savings Tracker Savings Planner Finance Tracker

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Federal Income Tax Fit Payroll Tax Calculation Youtube

47 Printable Employee Information Forms Personnel Information Sheets Templates Form Incident Report Form